Not financial advice. Full disclaimer available here.

The Dollar is about to make Emerging Market (EM) investors, myself included, look even more stupid than it already has. So it’s worth revisiting why emerging markets are attractive in the first place. This post is made of snippets from Ashmore’s latest annual report.

Exceptional valuations

Market conditions have left valuations across emerging markets at exceptionally attractive levels compared with history. Current asset prices heavily discount the known risks surrounding inflation, global rates, economic growth and, on probable scenarios, geopolitical issues.

External debt spreads1 are as wide as they were in 2008 and early 2020 (see chart below); equities trade at the widest discount to the US market in nearly 20 years2 ; and local currency bonds offer a real yield premium of approximately 500bps to developed world bond markets.3

Yet, emerging markets are closer to the end of their rate hiking cycles than developed world banks. In several of the major emerging countries, PMI surveys — leading indicators of economic activity — are in expansionary territory with manufacturing and new order PMIs above 50 and rising, whereas the same surveys show deterioration for developed countries.

Convergence trends

For the past 30 years, emerging markets have experienced powerful economic, political and social convergence trends with the developed world. These result in superior growth and investment opportunities.

While growth in GDP per capita has exceeded that delivered by developed countries over the past few decades, in absolute terms emerging markets are currently where the developed world was in 1983, according to the IMF. This underlines the further significant growth potential in these markets.

84% of the world’s population lives in an emerging country. EM account for 58% share of world GDP4 . Still, developed world investors typically have a 10% allocation or less to emerging markets. They remain heavily underweight. Over time, as the emerging world continues to deliver superior growth and investors’ misperceptions are challenged, these allocations will increase to more representative levels.

Geopolitics

The reshaping of political and trade relationships because of the Ukraine war and other tensions, mean that investors must prepare for a multi-polar world in which market leadership is likely to shift away from the US. In a scenario of permanently elevated geopolitical risks, countries that remain neutral to both ’cold’ and ’hot’ conflicts will become attractive destinations for investments.5

Most countries remaining neutral to the current conflicts are in emerging markets, in Latin America, Africa, the Middle East, and Central and South East Asia. A neutral position […] and increasingly significant trade between emerging countries and regions means that historical trading relationships can be revised to reflect the changing world.

New money

The investable capital within emerging countries is growing rapidly, approximately twice as fast as the developed world. This presents a significant growth opportunity in local asset management platforms6 , as well as cross-border emerging markets opportunities over the longer term.

In the past year, Ashmore’s local platforms proved resilient with aggregate AUM falling by only 3% versus 32 % for the group (18% in negative investment performance and 14% in net outflows).

Historically, EM wealth has gone to the developed world for safety. But it turns out the West is not so safe anymore. Here are a few examples:

Switzerland froze the assets of Russian citizens without due process

The LME cancelled trades in the nickel market to save their own interests

Canada seized people’s bank account for donating money to truckers

If you are a successful businessman from Brazil or Dubai, perhaps you are going to think twice before putting money into Europe or North America from now on. You might even conclude that the risk/reward is better at home.

Ashmore has a significant base of assets sourced from clients in emerging markets, representing 27% of group AUM.

Ashmore Group

For anyone who has not read the thesis on Ashmore, it is an active emerging market asset manager focused on fixed income which mostly looks after institutional clients. The group’s AUM are geographically diverse and atypical compared to benchmark indices with:

39% invested in Latin America,

29% in Asia Pacific,

20% in the Middle East and Africa

12% in Eastern Europe

The indexed investment universe is limited7 and active managers retain a significant competitive advantage through the ability to deliver alpha by accessing the full range of investment opportunities and taking advantage of price dislocations.

Ashmore has a proven track record of selectively acquiring assets in periods of market weakness, identifying cases where market prices have diverged from underlying fundamentals. After a period of market dislocation, the subsequent recovery returns and outperformance delivered by Ashmore’s investment processes have been substantial and delivered over an extended period of time.

Don’t panic!

Financial markets could get very ugly in the next few weeks but don't forget the long term bull case. Inevitably, there will be justification for the fall in value of some assets but others will have been mispriced in a period of risk aversion that leads to indiscriminate selling.

Difference in yield with US treasury. For example, the main sovereign external debt index (EMBI GD) traded at a spread of 540 basis points over US Treasuries at the end of June, a level seen only a few times over the past decade. The 20% decline in the external debt index in the first half of 2022 represents the index’s worst start to a year since 1995.

Equity valuations are at historical lows with the MSCI EM index trading close to 10x earnings.

The wider the spreads/premiums, the more attractive EM bonds are relative to developed markets.

On a purchasing power parity basis.

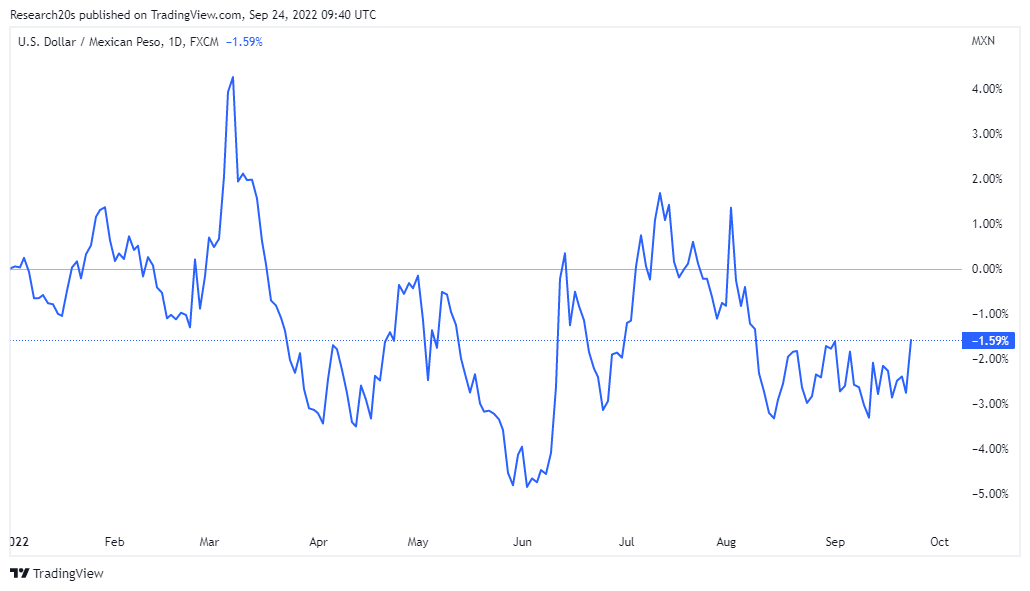

Charts of dollar/yen and the DXY are everywhere. But have you seen this one?

The Dollar is down against the Mexican Peso year to date and it’s down against the Brazilian Real.

Look, the US Dollar is the still most demanded currency and it might wreck the Pesos and the Real in the coming weeks as well. But isn’t it interesting that the most geographically distant countries from conflict zones also happen to have the strongest currencies this year?

Ashmore has local office investment teams in Colombia, India, Indonesia, Peru, Saudi Arabia and United Arab Emirates.

i.e. passive strategies & ETFs